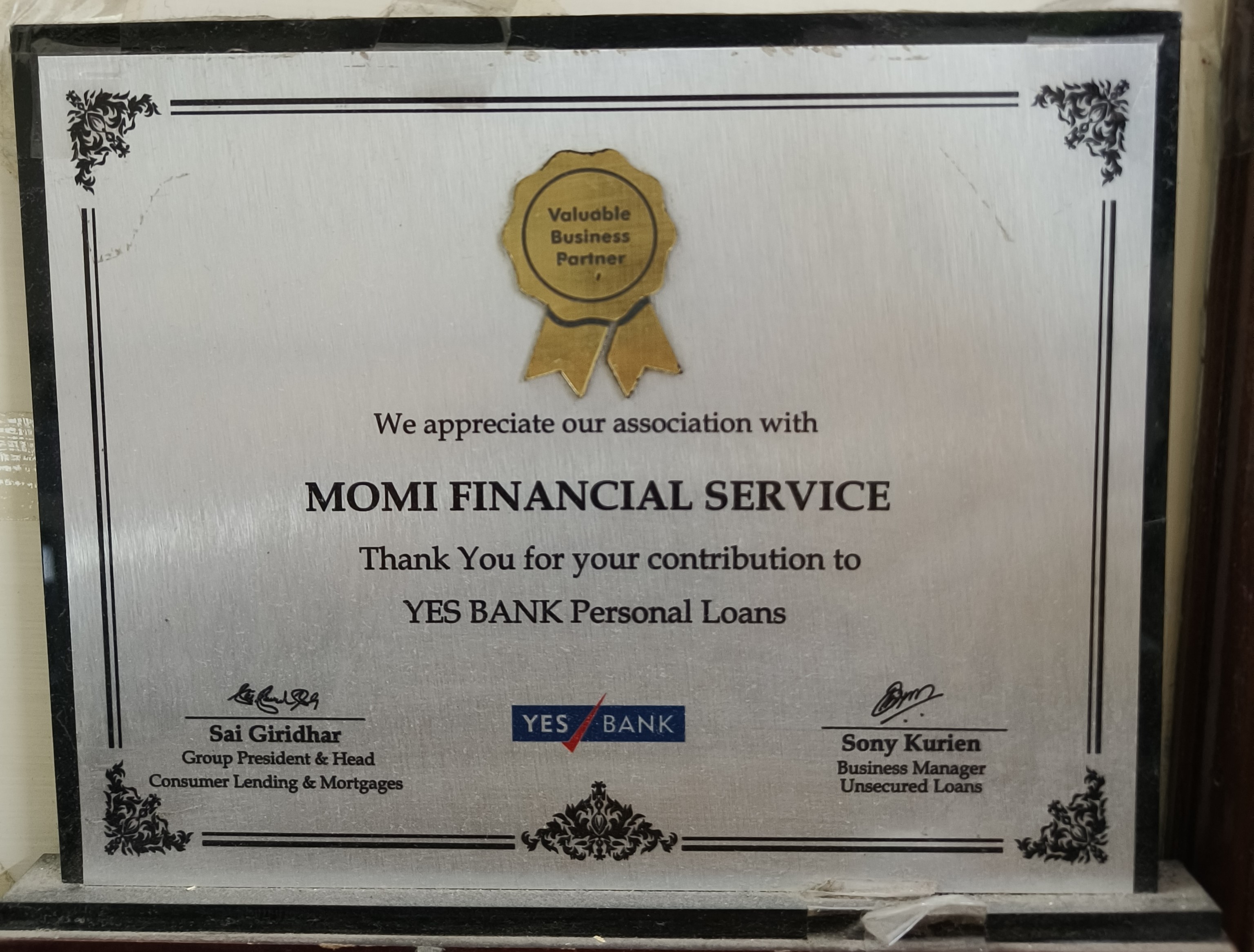

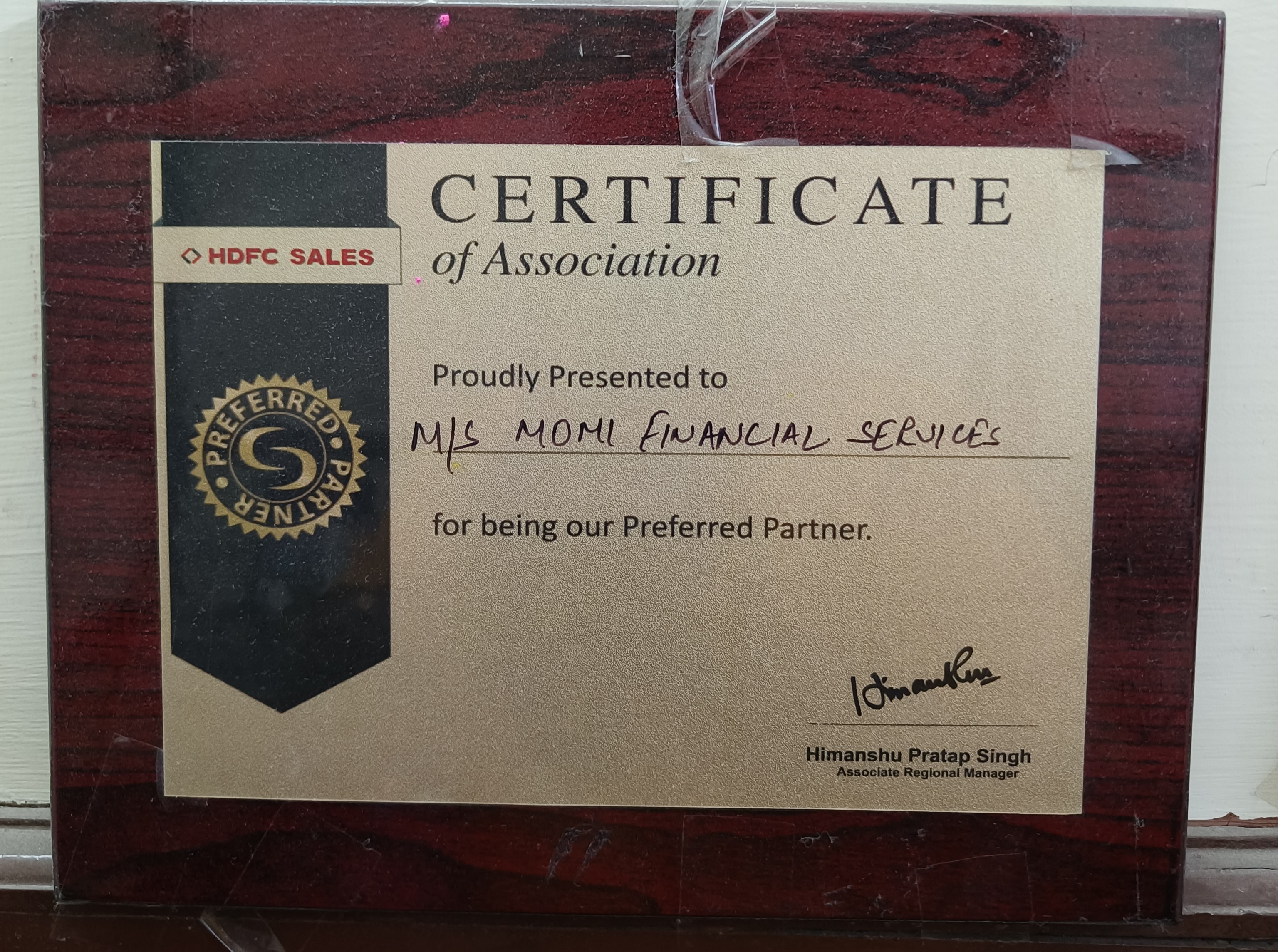

Get instant financial support for your needs such as education, travel, wedding, or medical emergencies.

Our Personal Loans come with flexible repayment options and quick disbursal.

What is a Personal Loan?

A Personal Loan is an unsecured loan provided by banks or financial institutions to meet personal expenses.

It does not require collateral and can be used for multiple purposes like education, travel, or emergencies.

Eligibility Criteria for Personal Loan

- Applicant must be between 21 – 60 years of age.

- Should have a stable income source (salaried or self-employed).

- Good credit score (650+ recommended).

FAQs on Personal Loan:

No, personal loans are unsecured loans and do not require collateral.

Once approved, funds are usually disbursed within 24–48 hours.

Loan amounts usually range from ₹50,000 to ₹25 Lakhs, depending on eligibility.

Yes, most lenders allow prepayment or foreclosure, but some may charge a small fee.

Expand or start your business with our specially designed Business Loans.

Ideal for SMEs, startups, and entrepreneurs looking for working capital, equipment purchase, or expansion.

What is a Business Loan?

A Business Loan is financial support given to businesses for growth, expansion, or working capital needs.

It can be secured or unsecured, depending on loan type and eligibility.

Eligibility Criteria for Business Loan

- Business must be operational for at least 2 years.

- Minimum turnover: ₹10 Lakhs annually.

- Applicant must be at least 21 years old.

FAQs on Business Loan:

Collateral may be required for higher loan amounts, but small-ticket loans can be unsecured.

Business registration, financial statements, tax returns, bank statements, and ID proof are typically required.

Approval usually takes 5–7 working days, depending on document verification and loan type.

Own your dream home with our affordable Home Loans. Whether it’s buying a new house,

constructing on your plot, or renovating your home – we’ve got you covered.

What is a Home Loan?

A Home Loan is financial support from banks or financial institutions to buy, construct, or renovate residential property.

The property itself serves as collateral against the loan.

Eligibility Criteria for Home Loan

- Applicant must be between 21 – 65 years.

- Stable source of income (salaried/self-employed).

- Credit history and repayment ability are checked.

FAQs on Home Loan:

Yes, you can claim tax benefits under Section 80C and 24(b) of the Income Tax Act.

Home loans generally come with tenures ranging from 5 years to 30 years.

Missing an EMI may attract late payment charges and impact your credit score negatively.